The Board of Directors of the CMA CGM Group met under the chairmanship of Rodolphe Saadé, Chairman and Chief Executive Officer, to review the financial statements for the third quarter of 2023.

Commenting on the results for the period, Rodolphe Saadé, Chairman and Chief Executive Officer of the CMA CGM Group, said: “The industry continued to normalize in the third quarter, with a return to pre-pandemic market conditions. Our performance remained very solid however, confirming the relevance of our growth strategy in terminals and logistics. We are consequently more resilient as we enter this new cycle.

The slowdown in the global economy is expected to continue weighing on our industry in the period ahead, but volumes carried are still robust. We remain committed to controlling our operating costs, and are continuing to focus on decarbonizing and digitalizing the supply chain to best meet our customers’ needs.”

Third-quarter 2023 operating and financial performance

First-half 2023 trends remained at play in the third quarter of 2023, with deteriorated market conditions in the transport and logistics industry.

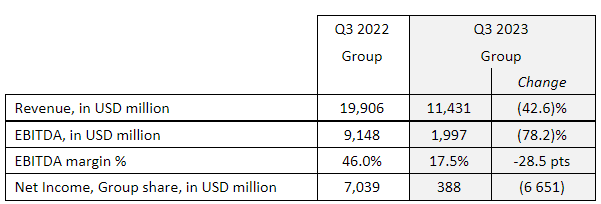

Revenue stood at USD 11.4 billion in the third quarter of 2023, with a gradual rebalancing of contributions from the Group’s maritime shipping and logistics businesses. EBITDA came to USD 2.0 billion, 78.2% lower than in third-quarter 2022. EBITDA margin came in at 17.5%, down 28.5 points and net income for the Group amounted to USD 388 million. The debt net of financial resources totaled USD 0.1 billion at September 30, 2023.

The Group is continuing to invest in its operating assets and in the energy transition for shipping and logistics:

- At the end of August 2023, CMA CGM completed its USD 2.8 billion acquisition of the GCT Bayonne and New York container terminals, renamed Port Liberty Bayonne and Port Liberty New York.

- CMA CGM is pursuing its voluntary investments to diversify the energy mix of its vessels, aiming to achieve Net Zero Carbon by 2050. It has already invested more than USD 17 billion in a fleet of nearly 120 LNG- and methanol-powered ships to be delivered by 2027.

Shipping

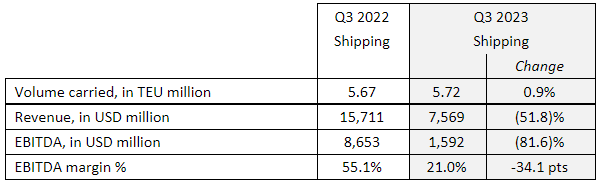

Consolidated revenue from the Group’s shipping operations amounted to USD 7.6 billion, down 51.8% year on year, reflecting the on-going normalization of freight rates. EBITDA totaled USD 1.6 billion, 81.6% lower than in third quarter 2022. EBITDA margin came in at 21.0%, down 34 points. Average revenue per TEU amounted to USD 1,322, down 52.3% year on year.

Volumes carried were up 0.9% compared to the same period in 2022, representing a total of 5.7 million TEUs. Volumes continued to grow on the North-South and short-sea lines, while further normalizing on the East-West lines, due to inventory drawdowns in the United States and more moderate household consumption in an inflationary environment.

Logistics

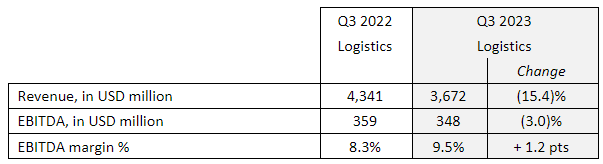

Revenue from logistics operations totaled USD 3.7 billion in the third quarter of the year. EBITDA stood at USD 348 million, a 3.0% decrease year on year.

The stability of the logistics business, at a time of declining trade, reflects on one hand the slowdown in freight markets and on the other hand the strengthening of the service offering and the resilience of certain activities.

Freight management activities were impacted by the declining market, that also effected the shipping segment. Contract logistics held up well, particularly in Europe. Finished vehicle logistics activities continued to perform well, supported by favorable market dynamics attributable to sustained demand, with supply chains returning to normal.

Other activities

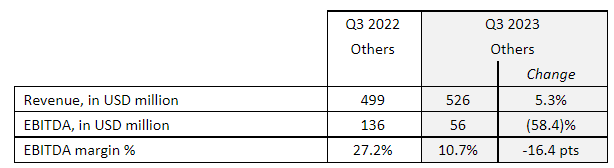

Revenue from other activities, including port terminals and CMA CGM AIR CARGO, rose by 5.3% to USD 526 million. EBITDA was USD 56 million, down 58.4%, mainly due to the normalization of volumes in port terminals and in particular a decrease in revenue from storage which was linked to congestions. In addition, the air freight market was affected by higher capacity in the face of weaSk demand.

Outlook

The third quarter of 2023 confirmed the trend towards normalization in the transport and logistics markets, with a return to 2019 pre-Covid conditions. Inventory drawdowns and inflation pressure continued to weigh on performance across the transport and logistics sector.

Macroeconomic forecasts point to a relative resilience in global economic activity in 2023, albeit at a level below the historical average, but they do not anticipate a recovery in 2024. However, this outlook contrasts with an expected rebound in world trade in 2024. New capacity expected on the market in 2024 will likely continue to pull down freight rates.

In this context, CMA CGM will continue to focus on maintaining operating cost discipline, rolling out its decarbonization policy and successfully integrating the strategic investments made over the last two years. The Group will also remain attentive to the geopolitical environment.

(CMA CGM)