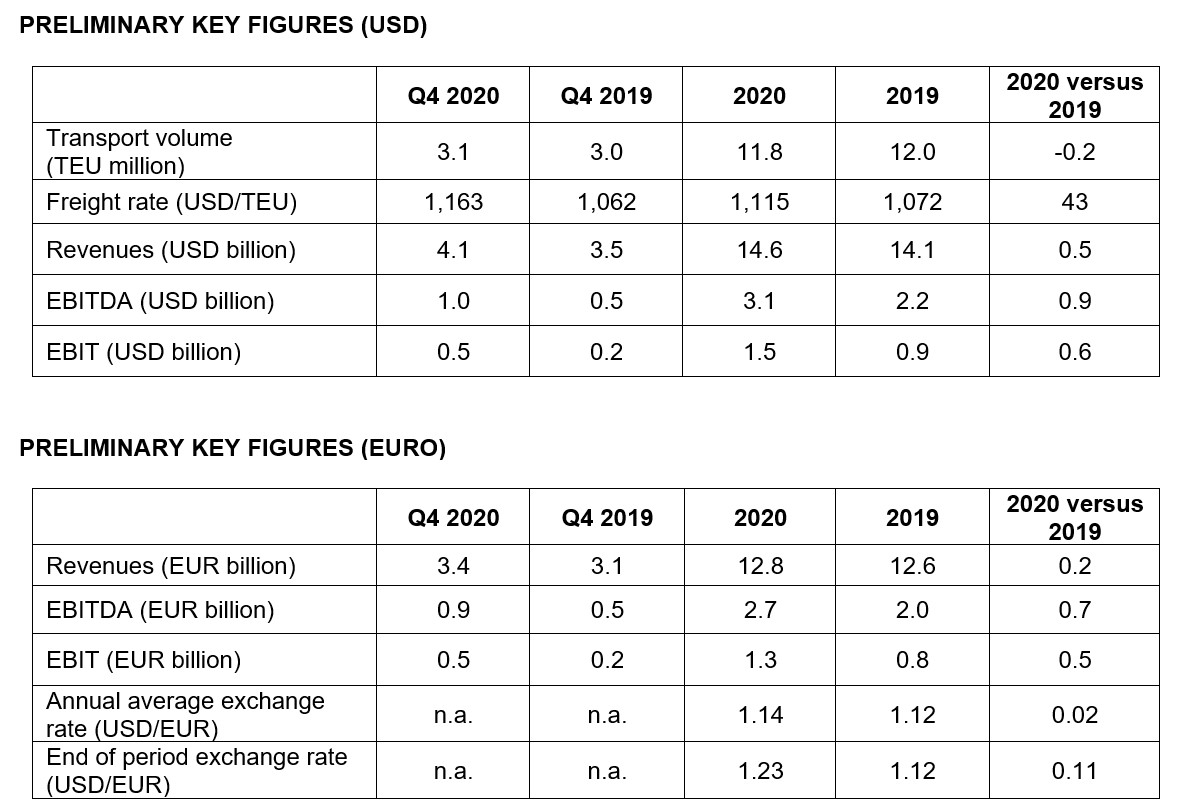

On the basis of preliminary figures, Hapag-Lloyd’s earnings before interest, taxes, depreciation and amortisation (EBITDA) for the 2020 financial year increased to more than USD 3 billion (approximately EUR 2.7 billion).

Earnings before interest and taxes (EBIT) rose to around USD 1.5 billion (approximately EUR 1.3 billion).

Both key figures are therefore in line with the most recently published earnings forecast for the 2020 financial year.

The main drivers of these positive business developments have been improved freight rates and lower bunker prices as well as cost savings of roughly USD 500 million resulting from the successful implementation of the Performance Safeguarding Program.

The EBIT also includes one-off expenses in Q4 2020 of around USD 140 million (approximately EUR 120 million), mainly related to fleet optimisation.

Revenues increased in the 2020 financial year by roughly 3 percent, to USD 14.6 billion (approximately EUR 12.8 billion). This is caused by an improved average freight rate of 1,115 USD/TEU (2019: 1,072 USD/TEU) whereas transport volumes were slightly below the level of the previous year at 11.8 million TEU (2019: 12.0 million TEU) or minus 1.6 per cent.

Hapag-Lloyd will publish its 2020 Annual Report with the audited financial figures and an outlook for the current financial year on 18 March 2021.